The following article, which examines bribery and corruption in the Asia-Pacific region and the approach that companies and other business actors must take, is written by Maurice Burke, partner, Singapore at Hogan Lovells, the Anglo-American law firm. The editors are grateful for these insights and invite responses. The usual editorial disclaimers apply. To comment, email tom.burroughes@wealthbriefing.com or jackie.bennion@clearviewpublishing.com

Cut costs, not compliance

Today’s marketplace is full of challenges for multinationals in search of growth opportunities. With political uncertainty in many developed markets, and the global economic growth continuing to slow, many ambitious corporates are boosting their profits by increasing their presence in emerging markets.

But although many of these markets offer great promise, they are also traditionally less transparent and harder to operate in, therefore increasing the risk of bribery and corruption.

Asian markets are hugely diverse in terms of their legal and regulatory processes, stage of economic development, and levels of bribery and corruption risk. For example, financial hub Singapore is often ranked one of the world’s least corrupt jurisdictions, while Indonesia has struggled with corruption but has recently seen some improvements, and Vietnam has been involved in several corruption scandals and seen its Corruption Perceptions Index score decline.

The reality is that in some markets in South-East Asia, corruption is still an everyday occurrence, making it very challenging for corporations to manage it effectively.

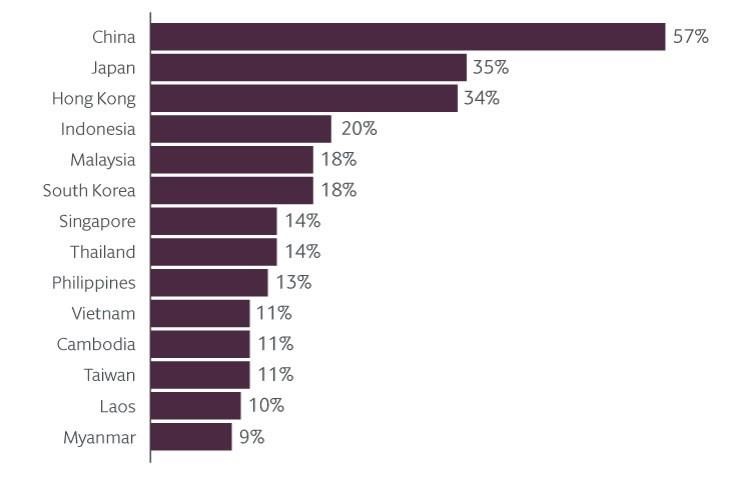

Figure 1: The markets in Asia that raise the most bribery and corruption concerns when it comes to doing business

Source: Hogan Lovells, Steering the Course II, February 2020

According to latest research released by Hogan Lovells, the Asian market most likely to cause concern is China. The sheer magnitude of China’s economy and the range of industries that operate in the country may go some way to explaining this finding. There are also cultural factors to consider, including the guanxi culture of relationship building through gift giving.

Risky Business: A balancing act

It’s clear that business leaders are struggling to balance the quest for corporate expansion with increased compliance pressure. More than two-thirds (68 per cent) of compliance leaders believe that regulatory pressure is increasing, and over half (52 per cent) say that although AB&C demands are ever-growing, their organisation is cutting overall budgets.

More alarmingly, almost 90 per cent of compliance leaders feel some kind of pressure to proceed with their growth strategy in Asia, Latin America, and Africa despite bribery and corruption concerns.

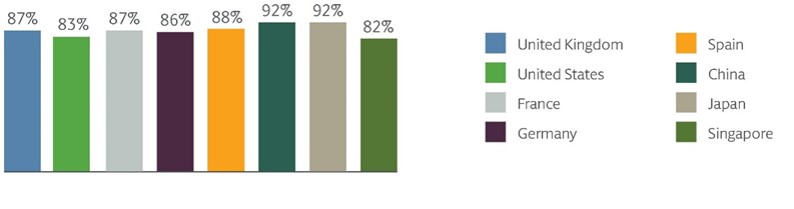

This is particularly acute in Asian markets such as China and Japan, where the highest proportions (92 per cent) of compliance leaders surveyed feel pressure to press ahead in spite of misgivings.

Figure 2: There is pressure within my organisation to proceed with the growth strategy in Asia, Latin America, and Africa, despite AB&C concerns

Source: Hogan Lovells, Steering the Course II, February 2020 Complexity and intensity

As research shows, while the compliance team may warn against entering certain jurisdictions at all, this is unlikely to be the path that the business follows, especially if the potential rewards are great. Leaders must therefore perform a delicate balancing act, proceeding with caution and putting robust compliance processes and procedures in place. However, our study reveals that many companies are failing to achieve this balancing act: 52 per cent of compliance leaders say that many people in their business fail to follow AB&C procedures, a deeply worrying statistic which highlights the challenge of effectively implementing policies, particularly in Asia’s fragmented landscape.

Compliance teams are dealing with increased complexity and intensity, as new layers of AB&C legislation are introduced. While companies could previously adopt a “one size fits all” approach by adhering to the strictest legislation, different laws now require different behaviours. Investigations are becoming more complex too, often incorporating a wide range of breaches, like fraud, money laundering, and corruption. Furthermore, the teams dealing with AB&C compliance are often also dealing with other aspects of compliance, such as data privacy and regulatory compliance, meaning that teams are increasingly stretched.

Continual reinvestment needed for robust AB&C capability

The repercussions for non-compliance can be severe. Last year alone saw an additional US$10 billion in fines for non-compliance with AML, KYC and sanctions regulations globally. An "ability to pay" analysis is often incorporated into the decision on the size of penalty, and it is becoming clear that this focuses on whether a company can pay and survive, rather than pay and thrive. Even when margins are tight, the compliance team is not the place to look for possible budget cuts. When it comes to AB&C compliance, awareness must lead to action.

As leaders deal with ever-changing regulatory landscapes and fast-paced political change, they must navigate the need for continual reinvestment in their AB&C governance practices, staying mindful of the serious long-term risks that come with non-compliance as they enter high-risk markets in pursuit of growth. With more regulations, higher fines, and fiercer enforcement across the globe, CEOs and their management teams must be fully apprised of regional and local laws before pushing ahead with investment and expansion plans.

Bribery and corruption activity is dynamic and fast-moving, meaning that effective AB&C compliance must be dynamic too.